I. Introduction

Holding cash has opportunity costs for firms. During financial crises and uncertain times, however, having a large cash balance helps firms to survive the crisis period with ease (Chen et al., 2018; Tekin & Polat, 2020a, 2020b, 2021). In addition, cash provides growth opportunities during economic recovery periods (Song & Lee, 2012), such that firms can seize profitable investment opportunities during times of distress. This study examines whether an agency cost explanation for cash policy is valid during and following the Global Financial Crisis (GFC). Focusing on 26 developing Asian countries with a large sample of 169,916 firm-years, we investigate the effect of governance and uncertainty on cash holdings.

The literature discusses the impact of financial crises on firm cash policy (Chen et al., 2018; Lozano & Yaman, 2020; Tekin & Polat, 2020b; Tran, 2020). Yet the role of governance during financial downturns is overlooked. Tekin (2020) focuses on the effect of the GFC and financial constraints on the adjustment speed of cash holdings. This author’s results imply that constrained firms adjust to their target level faster and that firms in poor governance countries have lower adjustment speed compared to their peers in good governance countries.

Agency conflicts between firm owners and managers impact cash holding decisions (Jensen, 1986). Managers may have an incentive to hoard cash, since this strengthens their discretionary power (Opler et al., 1999). However, there is mixed evidence on whether an agency motive implies a higher level of cash for poorly governed firms.[1] Dittmar et al. (2003) show that when legal protection is weak, firms tend to hold more cash. Seifert and Gonenc (2016) also support the agency motive from their finding that higher agency cost is associated with more cash holdings. On the other hand, Iskandar-Datta and Jia (2014) show that for places where legal protection is strong (i.e., lower agency costs), cash holdings are also higher. The literature also provides evidence that managerial entrenchment is associated with hoarding more cash (Harford et al., 2008). However, Ozkan and Ozkan (2004) find that the relationship between agency cost and cash level is non-monotonic.

During a financial crisis, since agency costs tend to be higher, holding extra cash may be even more important for firms operating in a poorly governed environment (Seifert & Gonenc, 2016). This is due to firms in poor governance countries having greater dependence on internal funding during a crisis. The agency motive then becomes stronger when agency costs are higher in a financial crisis. Therefore, we state our research question as follows:

How is the role of governance on cash management changed by the GFC in developing Asia?

We use a sample of 26 developing Asian countries over the period 1996–2017. Firm-level data are obtained from Worldscope. Governance data specific to each country is from Kaufmann et al. (2010). We use the fixed effects method to resolve any unobserved heterogeneity problems. Our results imply that cash holdings are the outcome of governance both before and during the GFC. However, cash holdings are a substitute for governance after the GFC. Specifically, firms operating in poor governance countries in developing Asia tend to hoard more cash post-GFC.

We contribute to the literature by investigating the impact of governance on cash policy in developing Asian markets, with the GFC as an exogenous shock. Our findings have several implications. First, managers should consider the escalating uncertainty during a crisis while making cash-related decisions. Policymakers should implement smart policies and regulations during times of exogenous shock from foreign crises like the GFC, to help firms hoard cash and strengthen their ability to survive.

This paper proceeds as follows. Section II explains the methodology and data. Section III discusses the empirical results. Finally, Section IV sets forth our conclusions.

II. Methodology and data

Using joint governance (GOV) by taking the annual average of six World Governance Indicators[2] (WGI), we assess the role of governance on cash management in 26 developing Asian countries[3] (United Nations, 2020). GOV appears to be a more appropriate variable than time-invariant variables, as it differs by country and year, capturing variations in governance and time (Tekin, 2020).

We split our sample to understand the changing impact of governance on cash across periods, as follows: entire sample (1996–2017), pre-GFC (1996–2007), GFC (2008–2009) and post-GFC (2010–2017). We also include firm-level control factors with firm and period dummies, as stated below:

\[\begin{align} {CASH}_{ij,t} = &\beta_{0} + \beta_{1}{GOV}_{j,t} + \beta_{2}{DIV}_{i,t} \\ &+ \beta_{3}{SIZE}_{i,t} + \beta_{4}{MBR}_{i,t} + \beta_{5}{INV}_{i,t} \\ &+ {\beta}_{6}{LEV}_{i,t} + \beta_{7}{NWC}_{i,t} + \beta_{8}{CFA}_{i,t} \\ &+ \beta_{9}{R\& D}_{i,t} + {\alpha}_{{ij}}F_{{i}} + {\alpha}_{t}Y_{{t}} + \varepsilon_{ij,t} \end{align} \tag{1}\]

where, CASHij,t is cash and short-term investments to total assets for firm i and market j at time t; GOVj,t is joint governance (annual average score of the mean of six governance indicators); DIVi,t is dividends (cash dividends / total assets); SIZEi,t is firm size (log of total assets); MBRi,t is market-to-book ratio ([total assets - book value of equity + market value of equity] / total assets); INVi,t is investments (capital expenditures / total assets); LEVi,t is leverage (total debt / total assets); NWCi,t is net working capital ([current assets - current liabilities - cash and short-term investments] / total assets); CFAi,t is cash flow ([pre-tax income + depreciation - cash and short-term investments] / total assets); R&Di,t is an R&D dummy (R&D expenses / total assets); Fi and Yt are firm and year fixed effects, respectively, controlling for unobservable factors that impact the cash ratio; and ɛij,t is the error term.

We retrieve firm-level data from Worldscope and governance variables from Kaufmann et al. (2010) for 26 developing Asian markets. Since publication of WGI begins in 1996, we determine the sample period as 1996–2017. Excluding financial and utility firms (Lozano & Yaman, 2020), our sample includes 169,916 firm-years from a sample of 14,430 non-financial Asian firms. We winsorize all firm-level variables at 1% and 99% (Tekin, 2020). In Table A.2, we introduce (i) mean of cash and governance across countries in Panel A, (ii) descriptive statistics in Panel B, and (iii) correlation matrix in Panel C, reporting the variance inflation factor (VIF[4]).

III. Empirical results

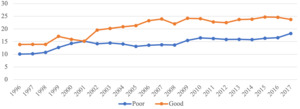

Given the occurrence of financial crises, the importance of cash management to firms’ trade and operations arises due to increasing costs for external financing. Thus, cash management becomes crucial to firm survival during exogenous shocks. We introduce cash mean by annually splitting the sample above- and below-mean considering governance level, as shown in Figure 1 and Table 1. As previous research (Tekin, 2020) confirms, firms in good governance countries have higher cash levels than those in poor governance countries over the study period, as shown in Figure 1.

In particular, firms in good governance countries increased their cash levels about 6% more in pre-GFC compared to the GFC period, whereas those in poor governance countries raised their cash stocks nearly 3% higher after the GFC compared to pre-GFC. In Table 1, we examine statistical differences in the mean of cash pre-crisis and post-crisis, across firms in poor and good governance countries. Overall, firms in good governance countries have about 7% higher cash over time, and all firms increase their cash stocks nearly 3% from pre- to post-crisis.

We analyze the association between governance and cash holdings in Table 2. We run our analysis by splitting the data as follows: pre-GFC (1996–2007), GFC (2008–2009), and post-GFC (2010–2017) in columns 1 to 3, respectively. In column 1, we indicate that firms in good governance countries increase their cash levels more, with the coefficient of 0.001 at the 1% level of significance for the pre-GFC period, in line with the literature (Iskandar-Datta & Jia, 2014). In column 2, similar to the pre-GFC period, the positive effect of governance on cash is equally significant during the GFC (the coefficient is 0.002 and significant at the 1% level). However, the picture changes[5] post-GFC, as shown in column 3. In particular, firms in poor governance countries raise more cash post-crisis (the coefficient is −0.002 at 1%). Thus, cash holding is a substitute for governance in developing Asia (Dittmar et al., 2003; Seifert & Gonenc, 2016). In sum, firms in poor governance Asian countries tend to increase cash holdings, as Tekin (2020) recently confirms using international evidence. Regarding robustness concerns, we rerun the analyses in Table 2 by employing net cash, calculated as cash and short-term investments to net assets (total assets minus short-term investments). These results are qualitatively similar to our main results. Therefore, the role of governance on cash does not depend on the measure of cash.

In addition, all firm-level control factors, excluding cash flow, are negatively related to cash holding over the entire period, but the picture differs in the subperiods. Specifically, firm size, market-to-book ratio, and R&D investment have no impact on cash pre-GFC but are negatively associated with cash post-GFC. These results demonstrate that agency, precautionary, and transaction motives of cash vary with the existence of exogenous shocks.

We test potential endogeneity between cash and governance by employing a panel reverse causality test. In Appendix tables, Table A.1, shows that while the coefficient of lagged GOV is 0.000 and is significant at the 1% level (column 1), the coefficient of lagged cash is insignificant (column 2). This suggests that cash holdings have no impact on governance, implying that our results do not suffer from endogeneity problems (Adjaoud & Ben-Amar, 2010).

IV. Conclusion

We assess how governance affects cash management in developing Asia before, during, and after the GFC. Employing fixed effects, our findings show that firms in poor governance developing Asian markets increase their cash levels more post-GFC. Namely, cash holdings have a substitution effect for governance post-GFC. On the other hand, the outcome role of governance strengthens from the pre-GFC to the GFC period. We contribute to the literature by extending the assessment of governance and cash management in light of the GFC. Our findings hold several implications. First, managers should make their cash decisions taking into account possible circumstances of market turmoil. Investors should consider the governance level of countries in determining where and which firms to invest in. Policymakers may strategically restructure policies and regulations associated with hoarding cash instead of disgorging cash, so as not to hurt firms in times of exogenous shock, such as the GFC. Practitioners and researchers should consider institutional settings and uncertainties and their impact on cash management in developing Asia. These results are especially applicable to the post-COVID-19 world, where unexpected shocks are becoming more common.